GST revenue for March 2024 witnessed the second-highest collection ever at Rs 1.78 lakh crore, with 11.5% year-on-year growth. With domestic transaction GST collection up 17.6%, this spike was mostly caused by this increase. The GST revenue for March 2024, net of refunds, is Rs 1.65 lakh crore, up 18.4% from the same time in the previous year.

Encouraging GST collection figures at ₹1.78 lakh crore which is second Highest,

This shows strong business growth and momentum in the economy compared to many other countries that are going into recession.

Due to a strong 17.6% increase in mop-up from domestic transactions, March 2024 saw the second-highest collection ever, totaling Rs 1.78 lakh crore, an 11.5 percent year-over-year improvement. In April 2023, 1.87 lakh crore was the biggest amount of GST ever collected.

Additionally, compared to the previous fiscal year, UPI transactions in India saw a record 57% increase in volume and 44% increase in value in FY24. With Rs 1.87 trillion, gross GST collection peaked in April of FY24.

Compared to the previous year’s average of Rs 1.5 lakh crore, the average monthly GST collection in the financial year 2023–24 increased to Rs 1.68 lakh crore. For the fiscal year 2023–2024, GST revenue net of refunds was Rs 18.01 lakh crore, representing a 13.4% increase over the previous year.

According to EY tax associate Saurabh Agarwal, “GST collection, marked by an impressive 11.5% year-on-year growth rate in March, underscores the resilience of our economy in the face of global challenges.”

On the other hand, the total cess on imported items increased by 3.7% to Rs 996 crore in the month.

Compared to the previous fiscal year, when the average monthly collection of GST was Rs 1.5 lakh crore, this fiscal year’s average monthly collection of GST is Rs 1.68 lakh crore. The growth in taxes collected on imported items is the primary driver of the increase in GST income. According to a breakdown of the taxes collected in March 2024, the following were collected: Rs 34,532 crore for the Central Goods and Services Tax (CGST), Rs 43,746 crore for the State Goods and Services Tax (SGST), Rs 87,947 crore for the Integrated Goods and Services Tax (IGST), which included Rs 40,322 crore for imported goods, and Rs 12,259 crore for the CESS, which included Rs 996 crore for imported goods.

Since these are gross amounts, it is difficult to determine whether the revised estimates included in the budget for 2023–2024 have been reached.

Similar to the budget estimates, the revised estimates for FY24 include an expected Rs 8.12 trillion from CGST.

In FY24, the average monthly collection exceeded Rs 1.5 trillion from the previous year to Rs 1.68 trillion.

Positive performance was observed in March 2024 for a number of components:

₹34,532 crore is the Central Goods and Services Tax (CGST).

₹43,746 crore is the state goods and services tax (SGST).

₹87,947 crore is the amount of Integrated products and Services Tax (IGST), which includes ₹40,322 crore for imported products.

₹12,259 crore as a cess (which includes ₹996 crore for imported products)

Throughout FY 2023–2024, similar patterns were noted:

₹3,75,710 crore for CGST

SGST amount: ₹4,71,195.

IGST: ₹10,26,790 crore, of which ₹4,83,086 crore is attributed to imports.

₹1,44,554 crore as a cess (which includes ₹11,915 crore for imported products)

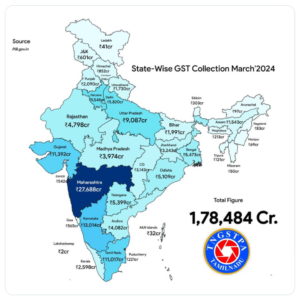

Maharashtra, Tamil Nadu, and Karnataka were among the states that led the increase in GST income collection. Karnataka’s GST mop-up increased by 26% to Rs 13,014 crore in March 2024, compared to Rs 10,360 crore in the same month the previous year. In March, Maharashtra’s revenue collection jumped by 22% year over year to Rs 27,688 crore, while Tamil Nadu’s monthly GST revenue increased by 19%. The states that contribute the most to India’s GST coffers are Maharashtra, Karnataka, Gujarat, and Tamil Nadu.

India allocated ₹43,264 crore to CGST and ₹37,704 crore to SGST from the IGST collected in March 2024. After regular settlement, this came to ₹77,796 crore for CGST and ₹81,450 crore for SGST. The central government paid ₹4,87,039 crore to the CGST and ₹4,12,028 crore to the SGST from the IGST that was collected during FY 2023–2024.